Start Learning Today

TG Investments and Research Finance Courses

Enroll instantly on Udemy or dive deeper on our dedicated landing pages. Courses cover FRTB, interest rate derivatives, MBS/ABS, and XVA with practical examples from 30+ years of capital markets experience.

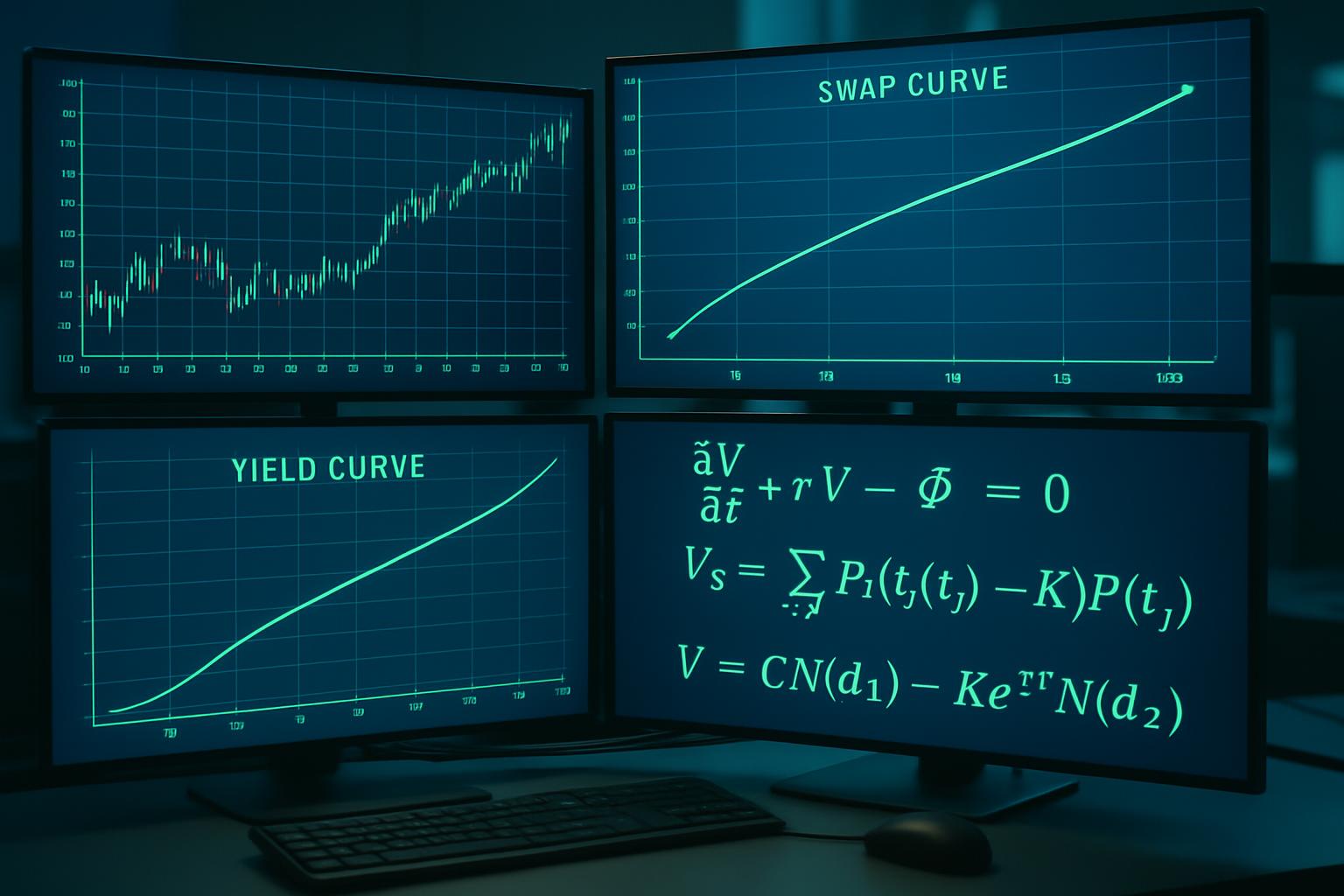

Mastering Interest Rate Derivatives

The Definitive Course for Finance Professionals

Comprehensive training on swaps, curves, caps, floors, and swaptions from industry experts with real-world trading floor experience.

- End-to-end swap pricing workflow

- Interest rate curve building

- Cap, floor & swaption pricing

- Wall Street expertise

- Practical trading applications

Mastering Mortgage and Asset Backed Securities

From the Basics to Advanced Analytics and 3rd Party Tools

From fundamentals to advanced concepts in securitizing, trading, and investing in mortgage and asset-backed securities.

- Securitization mechanics

- Prepayment & waterfall models

- Intex analytics platform

- Python cashflow calculations

- Advanced risk analysis

Fundamental Review of the Trading Book

Comprehensive Training for Banking Professionals

Master the Fundamental Review of the Trading Book with expert guidance on market risk capital rules, standardized approach, and internal models.

- Basel III market risk framework

- SA and IMA approaches

- Excel examples & Python code

- 12 comprehensive modules

- Regulatory compliance focus